ADDX, a blockchain and smart contract-based digital securities platform from Singapore raised $58 million from mainstream financial institutions to fund its goal of reducing minimum private investment sizes via tokenization and fractionalization.

The Monetary Authority of Singapore regulates ADDX as a digital securities exchange that aims to democratize private markets. The Pre-Series B funding round saw participation from the Stock Exchange of Thailand (SET), UOB, Nasdaq-listed Hamilton Lane and Thailand’s Krungsri Bank, which has brought total funds raised by ADDX to around $120 million.

As explained in the announcement, ADDX uses blockchain technology and smart contracts to tokenize and fractionalize private markets, including pre-IPO equity, private equity, and hedge funds and bonds. ADDX can reduce the minimum investment sizes for such private investments through tokenization.

According to ADDX, the platform effectively brings down private markets’ minimum investment threshold from $1 million to $10,000. In addition, as part of the investment, SET becomes entitled to appoint a board member for ADDX.

Moreover, ADDX intends to redirect some of the latest funding to other strategic initiatives, such as expanding the partnerships with issuers and supporting the launch of ADDX Advantage, a private market service for wealth managers.

Existing shareholders of ADDX include SGX, Heliconia Capital, Development Bank of Japan, Japan Investment Corporation, Tokai Tokyo, Kiatnakin Phatra and Hanwha Asset Management.

Related: Singaporean investors’ appetite for crypto is key to mainstream adoption – Survey

A survey conducted by Singapore’s first licensed crypto exchange Independent Reserve revealed tremendous investors’ support in the region, which might be key to mainstream adoption in the region.

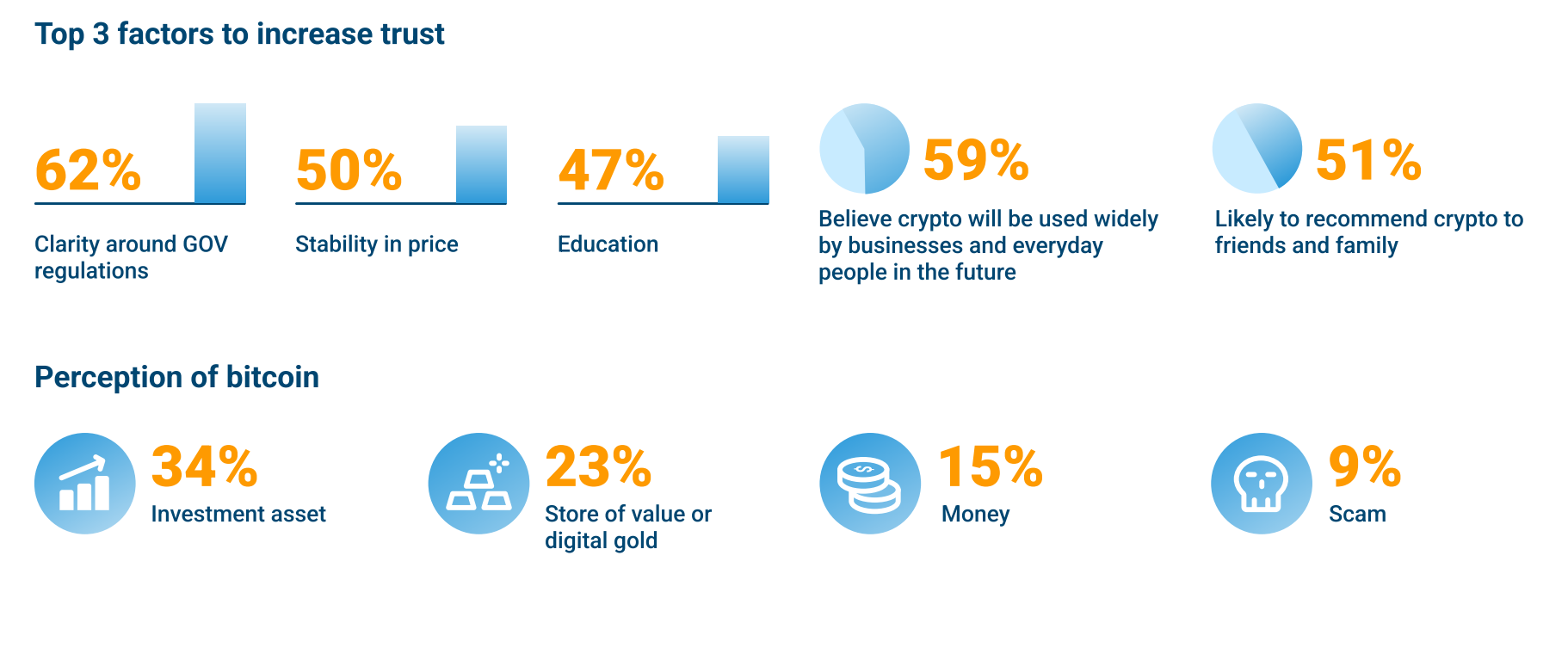

Factors for increasing trust among Singaporean investors. Source: Independent Reserve

Factors for increasing trust among Singaporean investors. Source: Independent Reserve

According to Raks Sondhi, managing director of Independent Reserve Singapore:

“58% [Singaporeans surveyed] perceive Bitcoin as an investment asset or a store of value.”

While nearly 60% of Singaporean investors envisioned mass-scale adoption of cryptocurrencies in 2021, 15% of the respondents from this year’s survey have started considering Bitcoin (BTC) as a real form of money.