The United States Department of Treasury and Internal Revenue Service (IRS) have filed 45 claims worth $44 billion against bankrupt cryptocurrency exchange FTX and its subsidiaries.

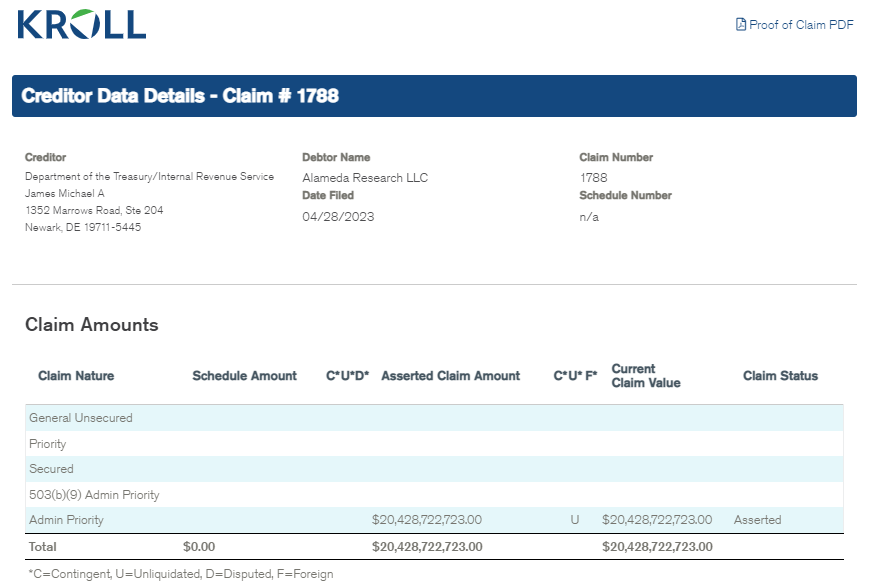

In what appears to be a tax bill for FTX’s sister company Alameda Research LLC that circulated online on May 10, the IRS assessed the firm $20.4 billion due in partnership taxes and payroll taxes. The assessment appears to match the IRS claim found on the website of Kroll’s Restructuring Administration practice, FTX’s claims agent.

A further $7.9 billion claim is made by the IRS against Alameda Research LLC, while two claims – $7.5 billion and $2.0 billion – are made against Alameda Research Holdings. The IRS filed the claims under “administrative priority,” enabling its claims to supersede that of unsecured creditors during bankruptcy proceedings.

While Alameda Research was headquartered in Hong Kong, its founders and key personnel, including Sam Bankman-Fried and Caroline Ellison, are U.S. nationals. Unlike most other countries, the U.S. uses a taxation-by-citizenship regime, meaning that U.S. nationals are liable for taxes on their worldwide income irrespective of their place of residence or how much time they spend in the U.S. each year. For partnership entities, taxes are not paid at the partnership level but are passed through their partners and taxed at the individual level.

In one single claim, the IRS assessed a balance of $20.4 billion against Alameda Research. Source: Kroll

In one single claim, the IRS assessed a balance of $20.4 billion against Alameda Research. Source: Kroll

In April, Cointelegraph reported that FTX had recovered $7.3 billion in assets and would consider rebooting the exchange next year. The announcement was made before the IRS’ claims, and at the time, FTX’s liabilities still outweighed its assets by an estimated $8.7 billion.

Magazine: Can you trust crypto exchanges after the collapse of FTX?

Cointelegraph reporter Turner Wright contributed to this story.