Canadian Bitcoin exchange-traded fund (ETF) holdings have increased to all-time highs according to recent research, and spot-based products are leading the way.

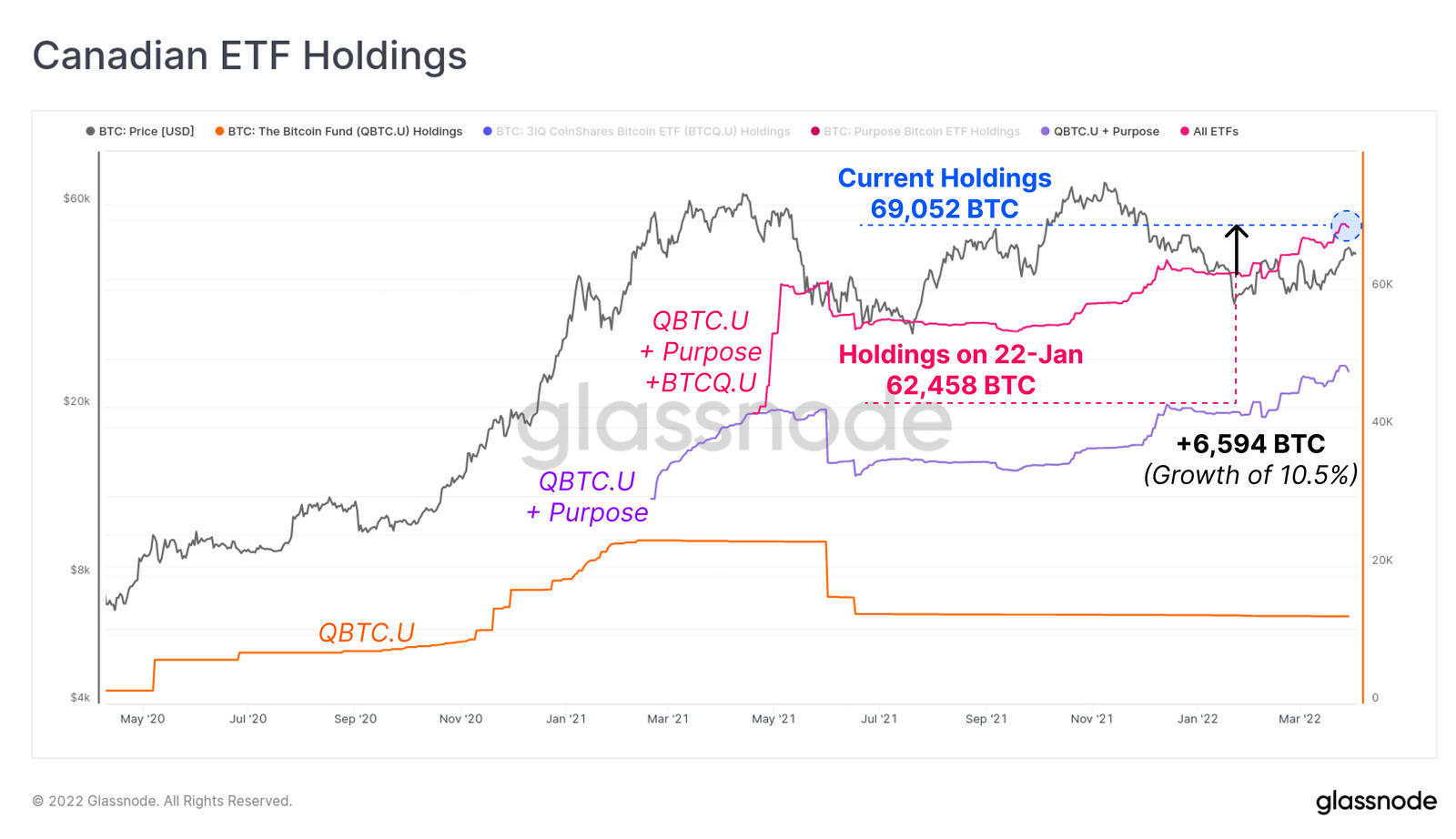

Canadian Bitcoin ETFs have increased their holdings by 6,594 Bitcoin (BTC) since January to reach an all-time high of 69,052 total BTC held.

The Purpose Bitcoin ETF saw the biggest increase in holdings over that time period with a net growth of 18.7% to 35,000 BTC, according to Glassnode.

An ETF is an exchange-traded fund that allows investors to speculate on the price of an asset without having to hold any themselves. The Purpose Bitcoin ETF, a spot Bitcoin ETF, currently has about $1.68 billion in assets under management. No such spot Bitcoin ETF is currently available in the U.S. but the metrics show that investors are hungry for the Canadian product.

Blockchain analytics firm Glassnode pointed out in its recent Week OnChain report that the crypto exchange outflow rate reached a 2022 high of 96,200 BTC per month.

The analytics provider commented on the juxtaposition of events concerning Bitcoin movements by saying:

“It is quite impressive to observe such strong outflows from exchanges (spot holdings), as well as inflows into both ETF products, DeFi applications, and on-chain accumulation wallets, despite the numerous macroeconomic and geopolitical headwinds of recent months.”

Bitcoin accumulation has been strong since around mid-March. The biggest accumulators have been so-called shrimps and whales. Shrimps are investors who hold 0 to 100 BTC, while whales are those who hold 1,000 to 10,000 BTC.

The #Bitcoin network has mined the 19 millionth $BTC, whilst accumulation by Shrimps alone surpass 1.7x daily issuance.

This week also saw an influx of buying from Luna Foundation Guard, inflows into Purpose ETF, and 1k+ $BTC Whales.

Read our analysishttps://t.co/o0S5AsYPYO

– glassnode (@glassnode) April 4, 2022

Among the biggest recent buyers is Terra’s Luna Foundation Guard (LFG) which is on a mission to acquire $3 billion worth of BTC.

Related: Terra smash-buys $139M Bitcoin, wallet reaches 31,000 BTC

With just 2 million BTC left to be mined since the 19 millionth coin was mined on April 1, the scarcity of Bitcoin is becoming an issue of note as adoption and investment increase across nations, corporations, and individuals.

Glassnode concluded that “the scarcity and pristine nature of Bitcoin as collateral may well be returning to the foreground once again.”