American crypto users haven’t lost their trust in “intermediaries” to hold their crypto, with a January survey from Paxos suggesting a majority of United States crypto hodlers still trust banks, exchanges and mobile payment apps to custody their assets.

An annual online survey published on Mar. 7 by the stablecoin issuer conducted between Jan. 5 and Jan. 6 sought to understand how the crypto winter and “large industry fallouts” in 2022 – including FTX and Alameda Research – impacted consumer behavior and confidence in the crypto ecosystem. Paxos noted:

“2022 was a rollercoaster year for the crypto industry.”

“Ranging from some of the highest Bitcoin prices ever to some of the lowest, largescale industry fallouts from companies like Terra, FTX, Alameda Research, and more – it was a volatile and potentially confidence-testing year for the ecosystem,” it added.

After a turbulent end to 2022, crypto consumers have remained confident for 2023. We conducted a consumer survey and found many reasons why crypto is still viewed as a primary staple for financial livelihoods. Read our full survey here: https://t.co/AwFrGMuX0r pic.twitter.com/TZcmct0O5L

– Paxos (@PaxosGlobal) March 7, 2023

However, the survey found that of those that heard and followed the FTX saga, more than half (57%) of respondents either planned to buy more crypto or simply do nothing as a result of the news.

It also found that 89% of respondents still trusted “intermediaries” such as “banks, crypto exchanges and/or mobile payment apps” to hold their crypto, stating:

“In fact, despite the high-profile collapses and underlying poor risk management practices seen in several crypto companies, crypto owners still trust intermediaries to hold crypto on their behalf.”

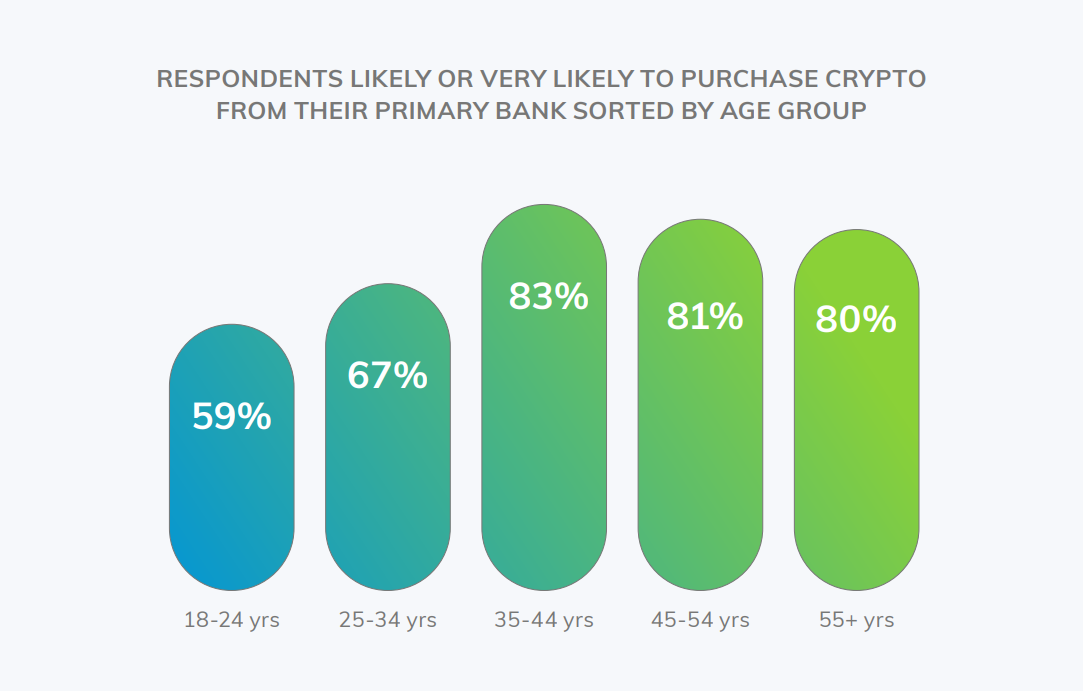

The survey also found more desire from consumers to be able to buy Bitcoin (BTC), Ether (ETH) and other digital assets from household or traditional banks, with 75% of respondents indicating they were “likely or very likely” to purchase crypto from their “primary bank” if it were offered, a 12 percentage point increase from the year before.

Graph showing respondents who indicated they were likely to purchase crypto from their primary bank. Source: Paxos

Graph showing respondents who indicated they were likely to purchase crypto from their primary bank. Source: Paxos

“Additionally, 45% of respondents reported they would be encouraged to invest more in crypto if there was more mainstream adoption by banks and other financial institutions,” Paxos added.

It said a “significant untapped opportunity” existed for banks if they expanded offerings to digital assets. “Not only would these services satisfy increasing demand, but they would also result in higher engagement,” Paxos claimed.

Related: Paxos is engaged in ‘constructive discussions’ with SEC: Report

Respondents qualified for the survey if they lived in the United States, were over 18 years of age, had a total household income greater than $50,000 and purchased cryptocurrency sometime within the last three years. The survey recruited 5,000 participants.

75% of respondents continued to be confident in the future of crypto. Source: Paxos

75% of respondents continued to be confident in the future of crypto. Source: Paxos

“Despite the volatile 2022 crypto landscape, consumers didn’t lose faith in their crypto investments. This number was unchanged from the previous year’s report, underlining the long-term confidence of those participating in crypto markets,” wrote Paxos.

The timing of the survey however means that the gleaned results did not take into account more recent crypto headwinds, such as the bankruptcy of crypto lender Genesis, the crackdown on Binance USD (BUSD) involving Paxos and the financial uncertainty of crypto bank Silvergate Capital.