Voyager Digital, the centralized finance (CeFi) platform that filed for Chapter 11 bankruptcy in July 2022, is reportedly selling assets through the Coinbase crypto exchange. On-chain data suggest that Voyager received at least $100 million in USD Coin (USDC) in three days, starting Feb. 24.

Since Valentine’s Day, Feb. 14, Voyager has sent crypto assets to Coinbase on an almost daily basis, alleges on-chain analyst Lookonchain. The investigation shows that Voyager transferred millions of dollars using a mixed bag of cryptocurrency tokens, including Ether (ETH), Shiba Inu (SHIB) and Chainlink (LINK).

1/ It seems that #Voyager is selling assets through #Coinbase.

We noticed that #Voyager has received 100M $ USDC from #Coinbase in the past 3 days.

And #Voyager has sent assets to #Coinbase almost every day from Feb 14.https://t.co/VW8o8dBQtqhttps://t.co/qbHt0r7VNG pic.twitter.com/kfxF6rwHFk

– Lookonchain (@lookonchain) February 26, 2023

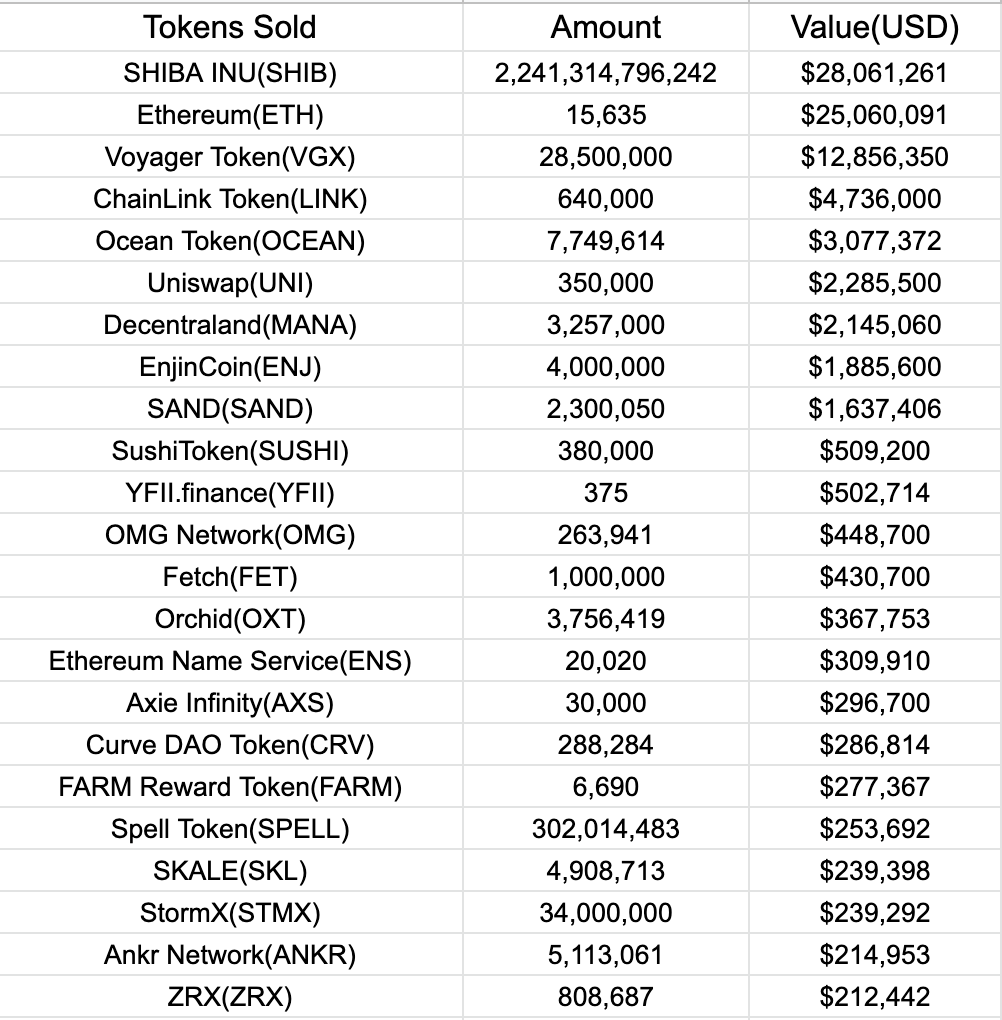

Lookonchain revealed Voyager’s use of 23 tokens, valued at over $100 million. The image below shows a list of tokens with their value in U.S. dollars. However, Coinbase has not yet responded to Cointelegraph’s request for comment to confirm the claim’s legitimacy.

List of tokens sold by Voyager on Coinbase. Source: Lookonchain

List of tokens sold by Voyager on Coinbase. Source: Lookonchain

Despite the sell-off, Voyager holds nearly $530 million in crypto, with the largest shares in Ether ($276 million) and Shiba Inu ($81 million).

Related: Voyager creditors serve SBF a subpoena to appear in court for a ‘remote deposition’

Amid the alleged sell-off of funds, the United States Securities and Exchange Commission (SEC) objected to Binance.US’ move to acquire over $1 billion of assets belonging to Voyager.

In a Feb. 22 filing submitted to the U.S. Bankruptcy Court for the Southern District of New York, the SEC stated:

“However, the Debtors (Binance.US) have yet to demonstrate that they would be able to conduct such sales in compliance with the federal securities laws.”

The filing highlights concerns over the lawfulness and ability to undertake planned asset restructuring through the acquisition. It also questions whether Voyager debtors can recoup some of their assets following the firm’s bankruptcy.