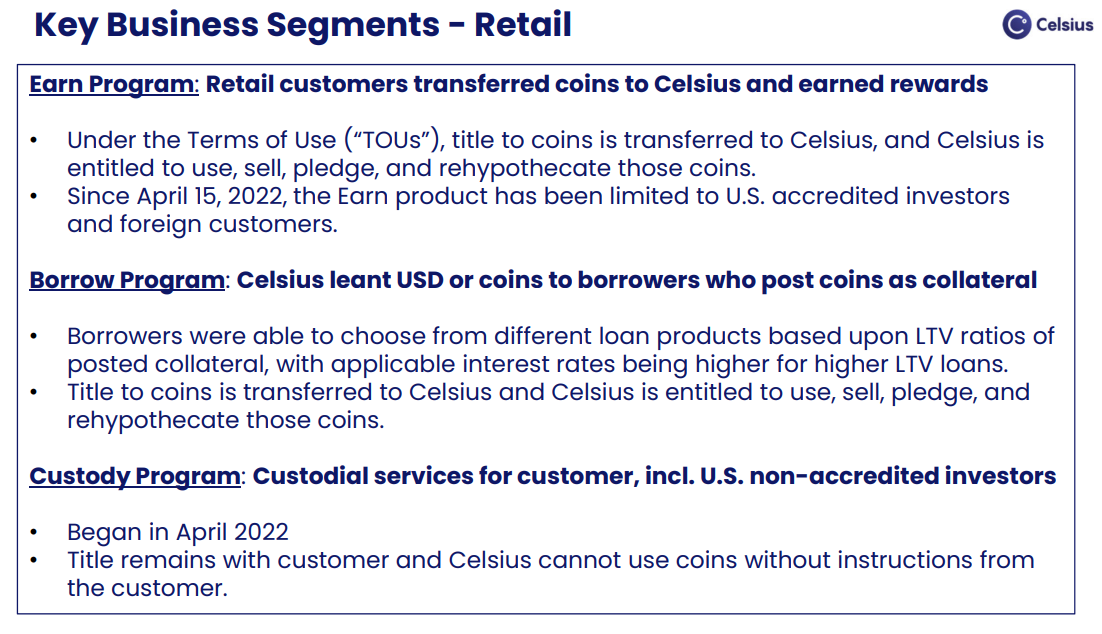

Celsius’s 1.7 million registered users across over 100 countries gave up title to the crypto they deposited into Earn and Borrow accounts, according to the firm’s lawyers.

At the first bankruptcy hearing for Celsius on July 18, lawyers from the Kirkland law firm led by Pat Nash detailed how retail users with Earn and Borrow accounts transferred the title of their coins to the firm as per its terms of service (ToS). As a result, Celsius is free to “use, sell, pledge, and rehypothecate those coins” as it wishes.

Terms of Service for Celsius accounts.

Terms of Service for Celsius accounts.

However, a legal question has arisen about whether Custody account holders retain title for their assets. Celsius ToS claims that the firm cannot use coins in Custody accounts without user permission. Still, lawyers questioned whether this holds for crypto that the firm is currently in possession of. In their overview of the case, they asked:

“Are the crypto assets in Celsius’ possession property of the estate? Is the answer to this question different for crypto assets held under the Custody vs. the Earn program?”

The Custody program was launched in April for non-accredited US investors as some states across the US issued cease and desist orders on Celsius’s Earn program.

Celsius paused withdrawals for all users on June 13 and stopped issuing new loans on July 13.

Attorney David Silver summed up Celsius’s claim to users’ funds in a July 18 tweet. He wrote that users should “stop thinking of it as *your* crypto” because it technically all belongs to the firm.

11) Celsius says that anyone in the EARN program has no crypto that belongs to them (i.e., stop thinking of it as *your* crypto). Celsius is the owner of the crypto assets. Most of the assets in Celsius came in through the EARN program and is part of the estate.

– David Silver (SILVER MILLER) (@dcsilver) July 18, 2022

According to a tweet from Financial Times reporter Kadhim Shubber, Nash proclaimed that Celsius users would be “interested in riding out this crypto winter” and let Celsius hold funds rather than sell. He added that this strategy would allow users the opportunity to “realize their recovery through an appreciation in the crypto macro environment.”

Essentially, Celsius would like to wait for the market to turn around before selling to ensure it can stay afloat, then pay off users with assets that have more value.

Nash says Celsius’ recovery plan will involve HODLing

“The vast majority of our customers are going to be interested in riding out this crypto winter, remaining long crypto, having the opportunity to realise their recovery through an appreciation in the crypto macro environment”

– kadhim (^ー^)ノ (@kadhim) July 18, 2022

The firm also claims that it can sell Bitcoin (BTC) that it mines through its subsidiary mining operation to pay off debts. Celsius CEO Alex Mashinsky affirmed in a bankruptcy filing document that his company planned to generate about 15,000 BTC through 2023, but David Silver was dubious about the claim.

Related: CoinFLEX resumes withdrawals, limiting users to 10%

Silver appeared in a Twitter Spaces after the hearing concluded. At about the 1:07 mark in the conversation, he stated that Celsius’s claim of being a Bitcoin mining company is disingenuous.

“Can you imagine right now that Patrick Nash, basically, and the Kirkland lawyers have now told you that Celsius is simply a Bitcoin mining company? Because that’s all fluff.”