Traditional hedge funds are slowly embracing cryptocurrency investments but are keeping their exposure limited as the market continues to mature, according to new research from PricewaterhouseCoopers, or PwC.

In its 4th Annual Global Crypto Hedge Fund Report 2022, PwC said roughly one-third of traditional hedge funds surveyed are already investing in digital assets such as Bitcoin (BTC). So-called “multi-strategy” hedge funds were most likely to invest, followed by macro strategy and equity strategy firms, respectively.

Of the hedge funds currently invested in the crypto space, 57% have allocated less than 1% of their total assets under management. Two-thirds of the firms currently invested plan to increase their exposure by the end of 2022.

Respondents cited “regulatory and tax uncertainty” as the single greatest barrier to investing. Specifically, hedge funds are concerned about a fragmented regulatory environment globally as well as unclear guidance on how the asset class will be governed.

A total of 89 hedge funds were included in the survey, which was conducted during the first quarter of 2022.

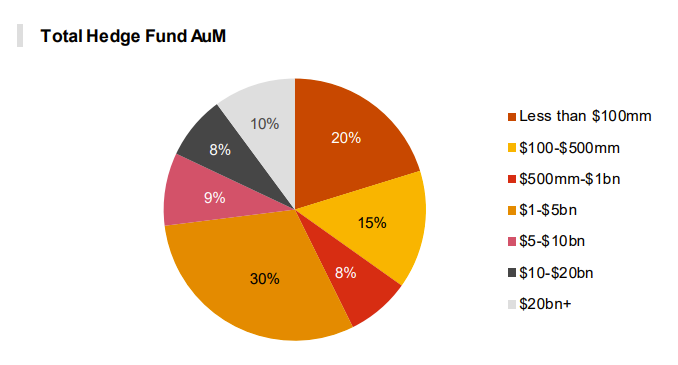

A majority of the hedge funds surveyed by PwC have more than $1 billion in assets under management. Source: PwC

A majority of the hedge funds surveyed by PwC have more than $1 billion in assets under management. Source: PwC

Hedge funds and other traditional asset managers have been eyeing developments in the crypto sector to gauge whether they should begin investing in the space. While several hedge funds have launched crypto divisions and started investing in the space, the majority of firms remain on the sidelines. Interestingly, a 2021 survey of 100 global hedge funds revealed that managers expect to allocate an average of 10.6% to crypto within five years.

Related: What is driving institutions to invest in crypto? BlockFi’s David Olsson explains

Although crypto assets have been in a protracted bear market for much of 2022, institutional investors appear to be buying the most recent price dip. Inflows into Bitcoin investment products, such as exchange-traded funds and Grayscale’s GBTC product, increased by $126 million last week, according to CoinShares. Bitcoin investment funds have quietly added over $500 million in net inflows this year.