Crypto markets remain volatile and a handful of seasoned traders believe that the bearish trend will continue as long as stock markets are chasing new lows.

Most investors would agree that crypto is now in a bear market and the current price action for Bitcoin (BTC) and Ethereum (ETH) suggest that capitulation and consolidation are a ways away.

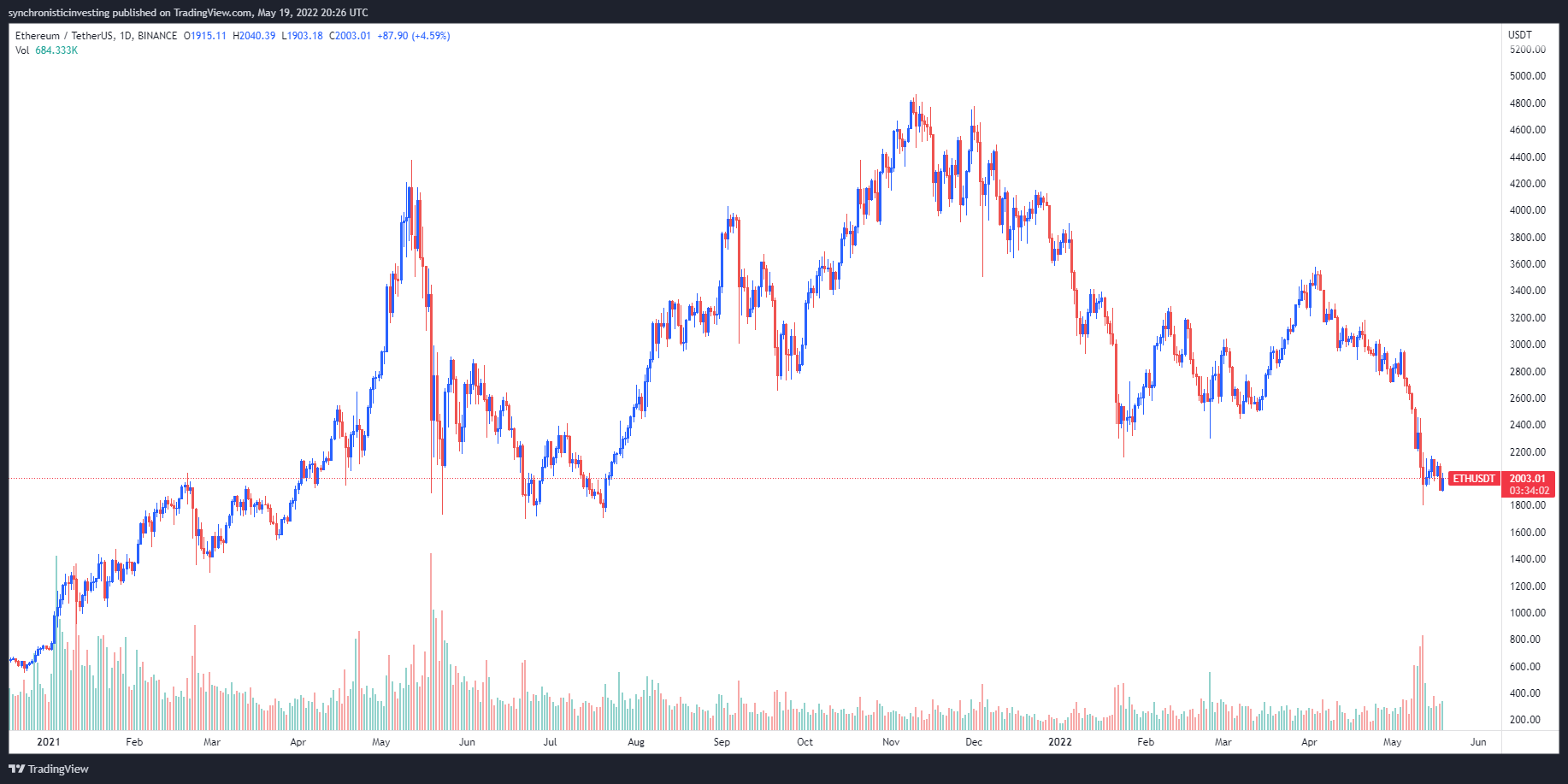

Data from Cointelegraph Markets Pro and TradingView shows that Ether still struggles to reclaim the $2,000 level as support and this zone has been a notable support and resistance since February 2021.

ETH/USDT 1-day chart. Source: TradingView

ETH/USDT 1-day chart. Source: TradingView

Ether needs a monthly close above $2,250

Insight into the major support level Ether needs to clear by the monthly close to regain a bullish outlook was touched on by market analyst and pseudonymous Twitter user ‘Rekt Capital’, who posted the following chart indicating the area near $2,269 is a key level.

ETH/USD 3-day chart. Source: Twitter

ETH/USD 3-day chart. Source: Twitter

Rekt Capital said,

“ETH is climbing closer and closer towards the key ~$2,250 level. The main question is whether that Monthly level will flip into new resistance once reached.”

Traders target $1,650

The possibility of a breakdown from the current support level was outlined in the following chart posted by crypto trader and pseudonymous Twitter user ‘Crypto Tony’, who is “expecting another drop further into the OB” where they are looking to have some orders filled.

ETH/USDT 3-day chart. Source: Twitter

ETH/USDT 3-day chart. Source: Twitter

Crypto Tony said,

“This move will be needed to engineer liquidity to propel us into the corrective wave. From there we see how it goes.”

Related: ‘Huge testing milestone’ for Ethereum: Ropsten testnet Merge set for June 8

Ether’s head and shoulders structure is complete

A potentially bearish sign appeared with the completion of a head and shoulders pattern on the weekly chart, a point highlighted in the following chart posted by ‘CryptoCharts’.

ETH/USD 1-week chart. Source: Twitter

ETH/USD 1-week chart. Source: Twitter

CryptoCharts said,

“With the recent sideways crypto market, we can clearly spot it out as if it’s a bounce or a breakout on the support highlighted. Here on the short-term timeframe, I will be keeping an eye closely to spot the breakout, or reversal breakout on the current support will lead the price towards the next support formed close to $1,300. Any bounce back will be continuing to rise toward $2,450.”

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.