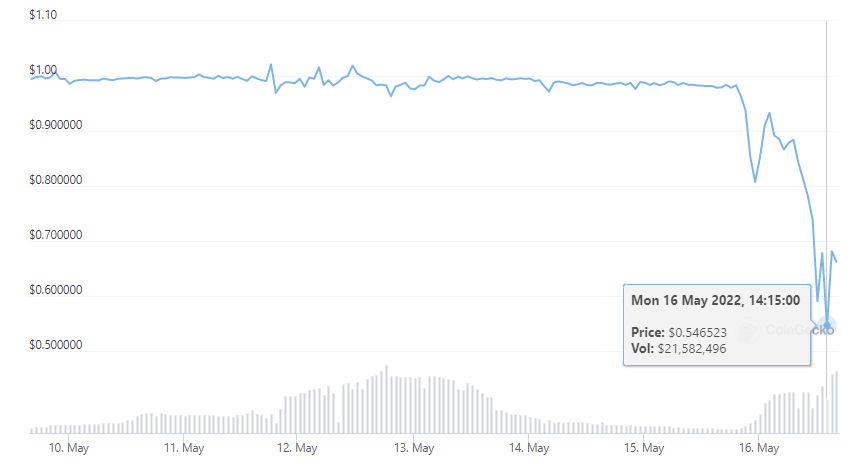

As the market continues to mourn over losses on the Terra UST and LUNA debacle, DEI, a stablecoin used as a collateral mechanism for third-party instruments built on the Fantom-based decentralized finance (DeFi) protocol DEUS Finance (DEUS), has failed to maintain its dollar peg, falling below 60 cents on Monday.

As the price of DEI hit an all-time low of $0.52, its market capitalization also followed, dropping from almost $100 million to around $52 million. However, despite the depegging of its stablecoin, DEUS Finance’s governance token, DEUS went up from $163.40 to $327.28, before falling to $255.36.

DEI price chart from CoinGecko

DEI price chart from CoinGecko

At the time of writing, DEI’s price is $0.66 with a market capitalization of $59 million. This follows stablecoin fears brought about by the UST and LUNA debacle and a decision by Deus Finance developers to pause DEI redemptions. However, according to its official Telegram channel, the DEI peg will be restored in the next 24 hours.

While DEI is also an algorithmic stablecoin like UST, the DEI stablecoin is collateralized, meaning that users are able to mint 1 DEI by depositing collateral worth 1 dollar. These can be assets like USD Coin (USDC), Fantom (FTM), DAI, WBTC or DEUS.

Similar to UST, DEI’s peg is stabilized by a mechanism that involves the minting and burning of DEUS. When minting DEI, a DEUS collateral is burned unless other tokens are used as collateral. On the other hand, when redeeming DEI, DEUS is minted.

Related: USDT-dollar peg wobbles as markets continue to struggle: Tether CTO weighs-in

Back in March, the DeFi project became a victim of a hack that resulted in Dai (DAI) and Ether (ETH) losses worth $3 million. Because of this, the platform decided to close its DEI lending contract. A day after the Deus Finance exploit, DeFi protocols Agave and Hundred Finance also reported exploits that resulted in losses of various cryptos that were worth a total of $11 million.