Bitcoin (BTC) upended buy trends through May 10 as BTC/USD sank below $30,000 for the first time since July 2021.

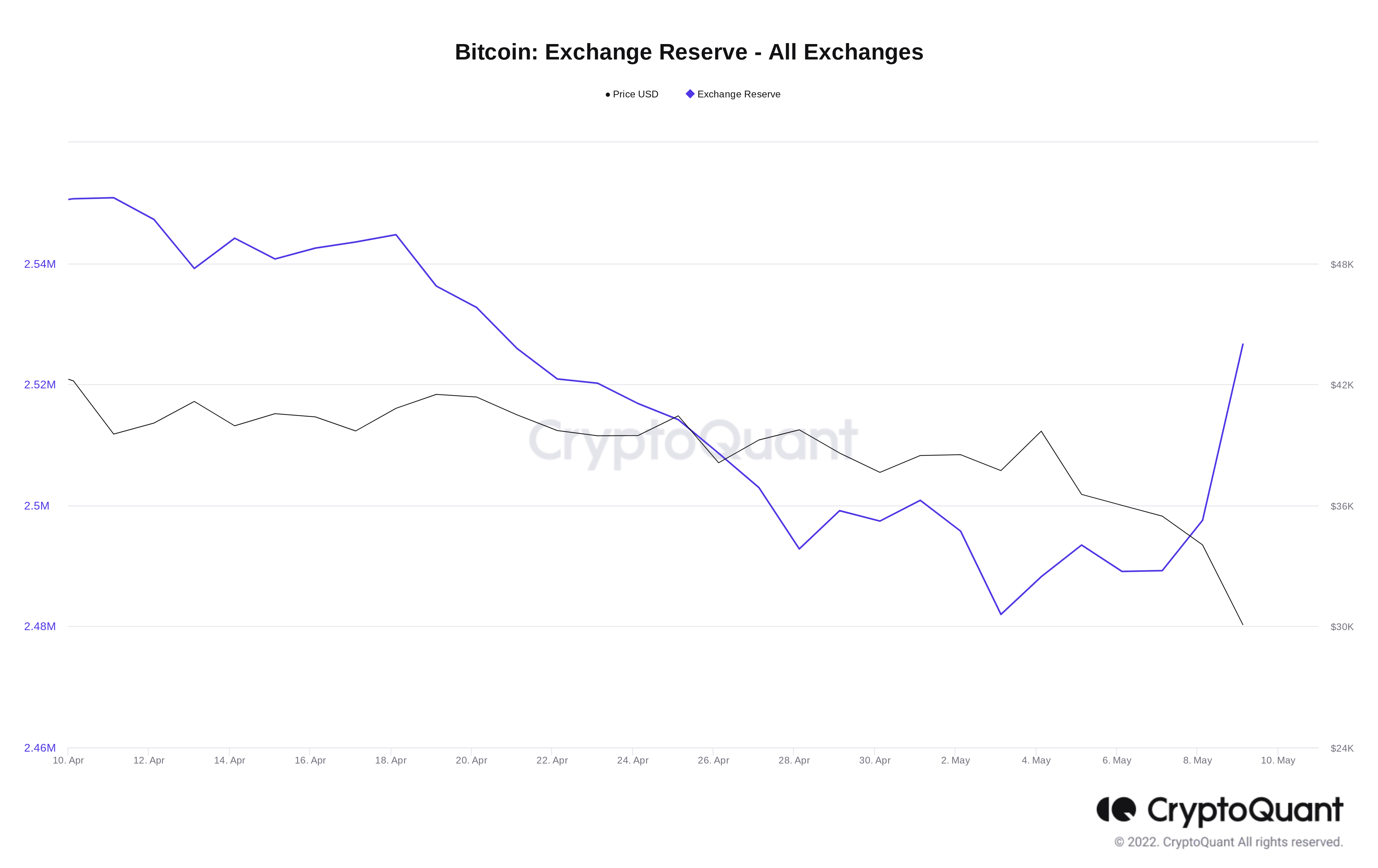

Data from on-chain analytics firm CryptoQuant showed exchange reserves start increasing as panic gripped crypto markets.

BTC flows back to exchanges

After seeing a sustained downtrend, the amount of BTC on major exchanges has begun to increase again.

According to CryptoQuant, which tracks the balance of 21 major exchanges, sellers sent a total of 37,537 BTC to accounts from May 6 to May 9 inclusive.

The deposits came as BTC price action fell from $36,000 to $29,700, subsequently recovering to near $32,000 at the time of writing on May 10.

Bitcoin exchange balance chart. Source: CryptoQuant

Bitcoin exchange balance chart. Source: CryptoQuant

In private comments to Cointelegraph, CryptoQuant head of marketing, Hochan Chung, said that the sell-off did not just involve speculators, but formed the next phase of a more concerted desire to reduce BTC exposure from Bitcoin’s biggest token holders.

“The massive inflow was not starting just yesterday. It has started since May,” he said.

“Bitcoin price declines on whale selling. Since early May, growing exchange reserves have been increasingly dominated by whale deposits. As whales move their coins to exchanges it puts downward pressure to bitcoin price.”

Other sources, as Cointelegraph reported, also noticed changing whale behavior, this nonetheless occurring comfortably above Bitcoin’s realized price of around $24,000.

Longs get punished across crypto

At the same time, other traders were less fortunate.

Related: ‘Kwontitative easing’ – BTC price hits $43K in UST as Terra empties $2.2B BTC bag

According to figures from on-chain monitoring resource Coinglass, Bitcoin’s fall below $30,000 triggered part of crypto market liquidations worth over $1 billion.

The majority of those were long positions coming from altcoins. In the 24 hours to the time of writing, BTC accounted for around $330 million of the liquidations total, with the remainder from altcoin tokens.

Crypto liquidations chart. Source: Coinglass

Crypto liquidations chart. Source: Coinglass

In terms of short-term price targets, however, the weekend’s CME futures gap centered on $35,000 was gathering popularity among traders on the day.

“Bitcoin looks like it’s on a mission to recover that CME gap,” popular Twitter account IncomeSharks said.

“The people who sold $34,000 to buy back at $37,000 will end up buying back above $40,000. Happens every time at bottoms. Bears getting greedy.”

CME Bitcoin futures 1-hour candle chart. Source: TradingView

CME Bitcoin futures 1-hour candle chart. Source: TradingView

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.