Circle’s stablecoin USD Coin (USDC) is climbing back to its $1 peg following confirmation from CEO Jeremy Allaire that its reserves are safe and the firm has new banking partners lined up at “banking open tomorrow morning.”

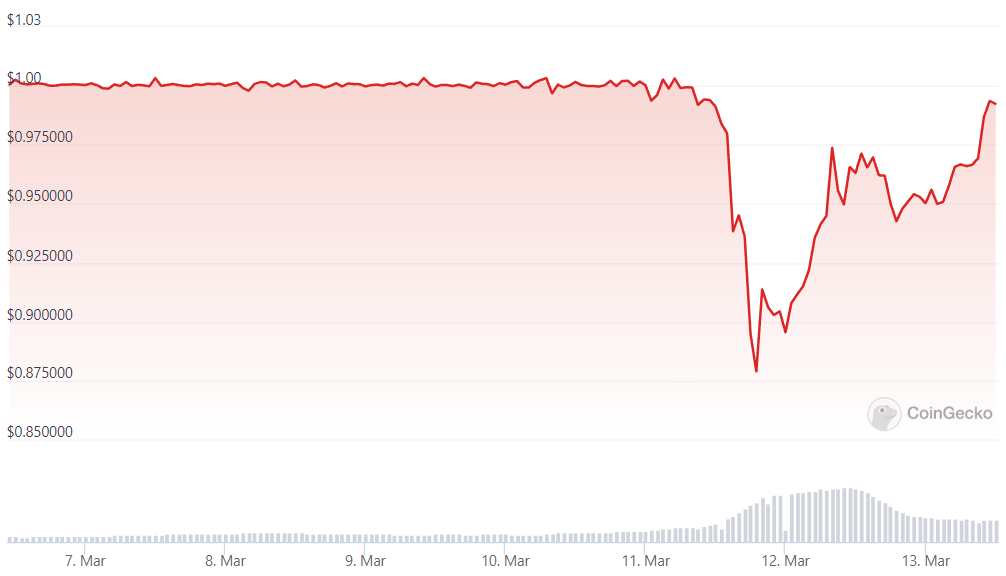

According to CoinGecko data, USDC is up 3.3% over the past 24 hours to sit at $0.99 at the time of writing.

USDC price chart. Source: CoinGecko

USDC price chart. Source: CoinGecko

The price dropped to as low as $0.87 over the weekend amid concerns about $3.3 billion worth of USDC reserves being held at Silicon Valley Bank, which was shut down by the California Department of Financial Protection and Innovation on March 10.

Circle also has an undisclosed amount of reserves stuck at the recently bankrupted Silvergate.

In a March 12 Twitter thread, Allaire praised the U.S. government and Federal Reserve for its $25 billion funding program to support liquidity-troubled banks such as SVB:

“100% of USDC reserves are also safe and secure, and we will complete our transfer for remaining SVB cash to BNY Mellon. As previously shared, liquidity operations for USDC will resume at banking open tomorrow morning.”

Update thread on USDC

We were heartened to see the US government and financial regulators take crucial steps to mitigate risks extending from the fractional banking system.

100% of deposits from SVB are secure and will be available at banking open tomorrow.

– Jeremy Allaire (@jerallaire) March 12, 2023

Allaire added that following the implosion of crypto-friendly Signature Bank on March 12, Circle is no longer able to process USDC minting and redemption through SigNet and that the firm will be temporarily “relying on settlements through BNY Mellon.”

The CEO outlined that things will move quickly in this regard however, as he revealed that Circle “bringing on a new transaction banking partner with automated minting and redemption potentially as soon as tomorrow.”

The statement from Allaire and the Federal Reserve announcements has been followed by a significant pump for asset prices across the board, with the total crypto market cap now above $1 trillion following its sharp drop to $961 billion on March 11.

Despite the turbulence we have seen in the traditional banking sector recently, Coinbase continues to operate as usual. At Coinbase all client funds continue to be safe and accessible including USDC conversions which will resume on Monday.

– Coinbase (@coinbase) March 12, 2023

Assets such as Bitcoin (BTC), Ether (ETH), Cardano (ADA), Polygon (MATIC) and Solana (SOL) have pumped a hefty 10.6%, 11.4%, 12.3%, 11.7% and 15.1% in the past 24 hours alone.

Notably this is despite Signature Bank collapsing.

Signature was seen as the last crypto-friendly bank standing in the U.S. following the closure of Silvergate and SVB, and it is now unclear what the major banking on- and off-ramps into crypto are.