Fresh data on Indian crypto exchanges’ trading volume reveals a significant decline in trading practices among Indians just ten days after the tax rule implementation. India’s new 30% crypto tax rule came into effect on April 1, despite many stakeholders and exchange operators warning against its ill effects.

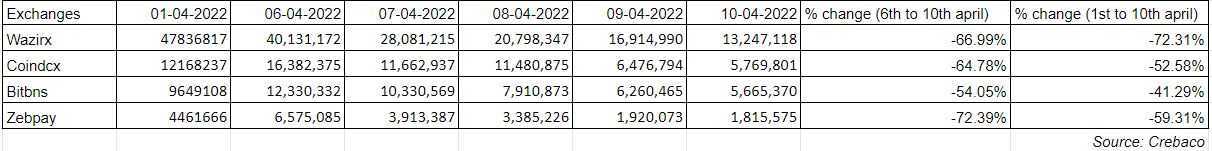

A research data report shared by Indian blockchain analytic firm Crebaco with Cointelegraph shows that trading volume on top Indian crypto exchanges has declined as high as 70% in the past 10 days.

Crypto Trading Volume on Major Indian Exchanges Source: Creabaco

Crypto Trading Volume on Major Indian Exchanges Source: Creabaco

The trading volume on WazirX, the leading crypto exchange in India, declined from $47.8 million on April 1 to $13.2 million on April 10. CoinDCX’s trading volume dropped from $12.16 million to $5.76 million, followed by Bitbns with an overall decline of 41.29% in the past ten days.

Apart from harsh crypto tax laws directly inspired by India’s gambling laws, many payment processing partners that offer Unified Payments Interface (UPI) accessibility have also severed ties with crypto exchanges.

Related: Coinbase to invest in Indian crypto and Web3 amid tax regulation clarity

Coinbase recently had to suspend the crypto payment option just a day after inaugurating its crypto trading services for Indians. While payment processors such as MobiKwik had cut ties with the likes of WazirX and other crypto exchanges after a recent warning from the government.

Statement by NPCI as on 7th April 2022. With reference to some recent media reports around the purchase of Cryptocurrencies using UPI, National Payments Corporation of India would like to clarify that we are not aware of any crypto exchange using UPI. Please see attached document pic.twitter.com/lGTcaSLKeC

– NPCI (@NPCI_NPCI) April 7, 2022

Interestingly enough, even though crypto taxes have been based on the gambling laws, the fantasy sports and gambling apps in the country have full access to all forms of payment integration including UPI.

Coinbase disabled UPI service in India few days after NPCI statement.

This is not new, Indian exchanges have also been facing payment service problem since 2018.

Weird fact – Actual gambling apps get proper payment service support while crypto exchanges are being alienated.

– Aditya Singh (@CryptooAdy) April 10, 2022

Many stakeholders in the crypto community have warned that these impractical tax measures and added restrictions on crypto trading would do more harm to the thriving crypto economy in the country and the early effects are visible.