Him Das, the acting director of the United States Financial Crimes Enforcement Network, or FinCEN, said some of the government bureau’s tools to fight money laundering and terrorism financing may be ill suited for crypto.

In a Thursday hearing of the House Financial Services Committee on ‘Oversight of the Financial Crimes Enforcement Network’, Das addressed concerns from lawmakers regarding FinCEN’s authority to pursue information on illicit digital asset transactions. Kentucky Representative Andy Barr said many of the current ‘special measures’ FinCEN was authorized to use under Section 311 of the PATRIOT Act were “rarely used,” while Das hinted that digital assets were essentially new ground for the law aimed at anti-money laundering, or AML, and countering the financing of terrorism, or CFT.

“Section 311 was enacted in a time when most financial relationships and transactions were done through the traditional banking system where there are traditional correspondent account relationships,” said Das. “Nowadays, cross-border transactions often include money services businesses, payment systems, […] foreign exchange houses as well as cryptocurrency.”

Das added that FinCEN’s current authority under the PATRIOT Act would likely not stop actors from engaging in illicit transactions for ransomware attacks and darknet markets:

“Currently, the Section 311 authority is not right-sized for the types of threats that we’re seeing through the use of cryptocurrency.”

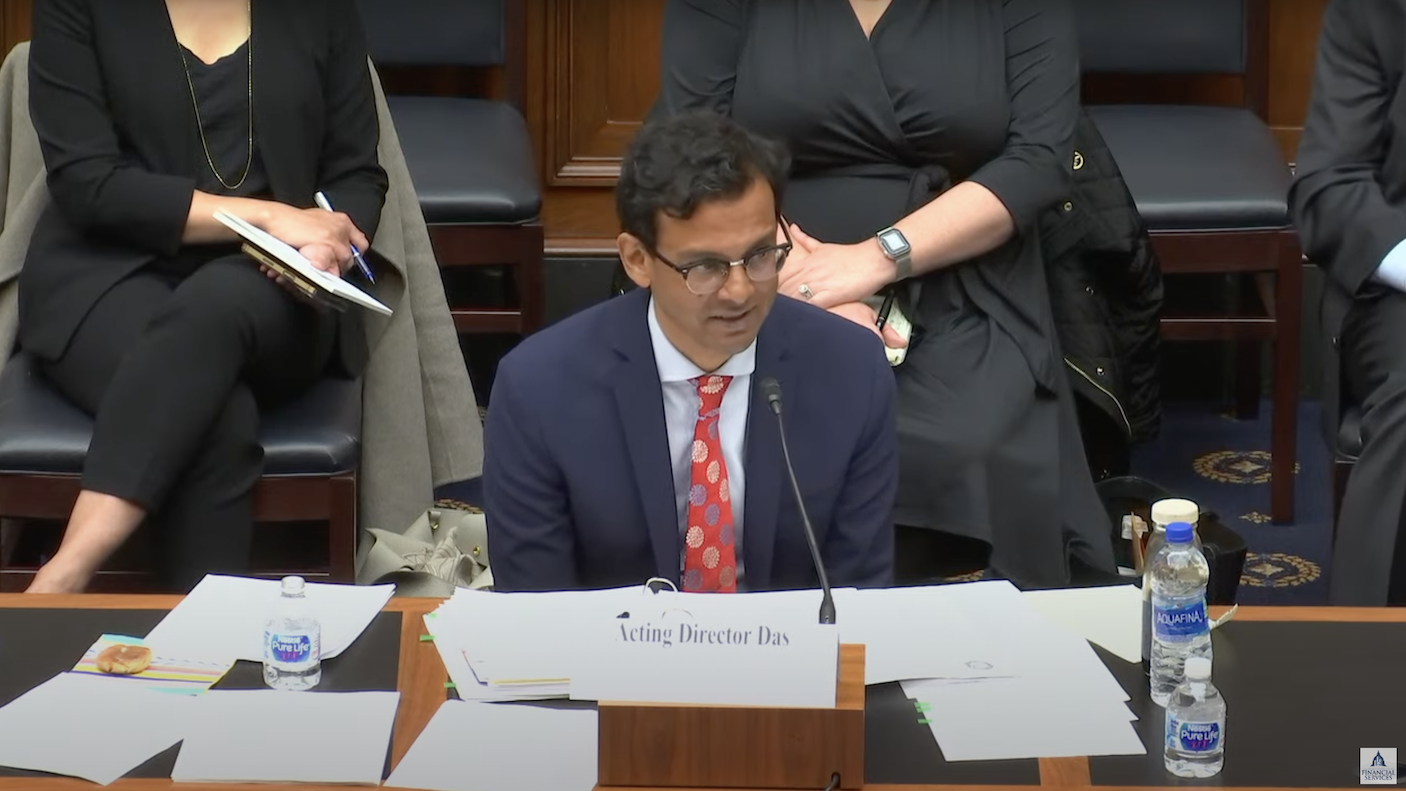

FinCEN acting director Him Das addressing House Financial Services Committee on April 28

FinCEN acting director Him Das addressing House Financial Services Committee on April 28

In addition to questions regarding FinCEN’s authority to assess suspicious transactions, many lawmakers questioned how the bureau might handle Russian oligarchs and entities using cryptocurrency to evade sanctions. Das reiterated FinCEN’s position from March that the Russian government was unlikely to use convertible virtual currencies to evade large-scale sanctions, but would continue to monitor the situation:

“We’ve not seen large-scale evasion through the use of cryptocurrency, but we’re mindful of that and we’re working with financial institutions so that they’re aware of that potential that we can identify a large-scale evasion using cryptocurrency and act on it as well.”

Related: The new episode of crypto regulation: The Empire Strikes Back

According to Das, FinCEN will also be considering how to handle financial monitoring requirements for crypto firms that facilitate certain transactions to self-custodied, or unhosted, wallets. The U.S. Treasury Department proposed Know Your Customer rules on unhosted wallets in December 2020 for transactions of more than $3,000, and hinted in its semiannual agenda and regulatory plan released in January it would be looking at regulating this aspect of the crypto space.

“It’s not that unhosted wallets are entirely opaque,” said Das. “Unhosted wallets often engage in transactions with cryptocurrency exchanges, which are subject to AML/CFT regulation […] Law enforcement can engage with cryptocurrency exchanges with respect to suspicious activity reporting and other reports that might be applicable to them in terms of getting some degree of understanding in terms of transactions with unhosted wallets as well.”