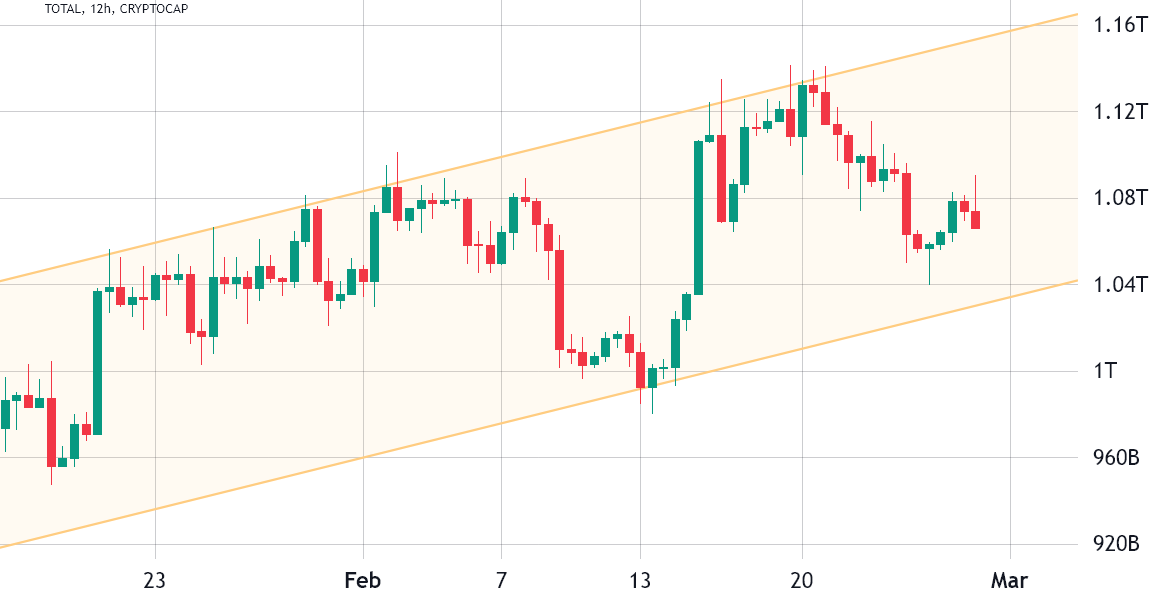

The recent weakness in the crypto market has not invalidated the six-week-long ascending trend, even after a failed test of the channel’s upper band on Feb. 21. The total crypto market capitalization remains above the psychological $1 trillion mark and, more importantly, cautiously optimistic after a new round of negative remarks from regulators.

Total crypto market cap in USD, 12-hour. Source: TradingView

Total crypto market cap in USD, 12-hour. Source: TradingView

As displayed above, the ascending channel initiated in mid-January has room for an additional 3.5% correction down to $1.025 trillion market capitalization while still sustaining the bullish formation.

That is excellent news considering the FUD – fear, uncertainty and doubt – brought down by regulators regarding the cryptocurrency industry.

Recent examples of bad news are, a United States District Court judge ruling that emojis such as the rocket ship, stock chart and money bags infer “a financial return on investment,” according to a recent court filing. On Feb. 22, a federal court judge ruling on a case against Dapper Labs denied a motion to dismiss the complaint alleging that its NBA Top Shot Moments violated security laws by using such emojis to denote profit.

Outside of the U.S., on Feb. 23, the International Monetary Fund (IMF) issued guidance on how countries should treat crypto assets, strongly advising against giving Bitcoin a legal tender status. The paper stated, “while the supposed potential benefits from crypto assets have yet to materialize, significant risks have emerged.”

IMF directors added that “the widespread adoption of crypto assets could undermine the effectiveness of monetary policy, circumvent capital flow management measures, and exacerbate fiscal risks.” In short, those policy guidelines created additional FUD that caused investors to rethink their exposure to the cryptocurrency sector.

The 5.5% weekly decline in total market capitalization since Feb. 20 was driven by the 6.3% loss from Bitcoin (BTC) and Ether’s (ETH) 4.6% price decline. Consequently, the correction in altcoins was even more robust, with 9 out of the top 80 cryptocurrencies down by 15% or more in 7 days.

Weekly winners and losers among the top 80 coins. Source: Messari

Weekly winners and losers among the top 80 coins. Source: Messari

Stacks (STX) gained 53% after the project announced its v2.1 update to strengthen the connection to Bitcoin-native assets and improve its smart contracts’ control.

Optimism (OP) rallied 13% as the protocol released the details of its upcoming superchain network, which focuses on interoperability across blockchains.

Curve (CRV) traded down 21% after an Ethereum security analytics firm suggested verkle trees implementation, which could severely impact Curve Finance’s use on the mainnet, according to its team.

Leverage demand is balanced despite the price correction

Perpetual contracts, also known as inverse swaps, have an embedded rate that is usually charged every eight hours. Exchanges use this fee to avoid exchange risk imbalances.

A positive funding rate indicates that longs (buyers) demand more leverage. However, the opposite situation occurs when shorts (sellers) require additional leverage, causing the funding rate to turn negative.

Perpetual futures accumulated 7-day funding rate on Feb. 27. Source: Coinglass

Perpetual futures accumulated 7-day funding rate on Feb. 27. Source: Coinglass

The 7-day funding rate was marginally positive for Bitcoin and Ethereum, thus a balanced demand between leverage longs (buyers) and shorts (sellers). The only exception was the slightly higher demand for betting against BNB price, although it is not significant.

The options put/call ratio remains optimistic

Traders can gauge the market’s overall sentiment by measuring whether more activity is going through call (buy) options or put (sell) options. Generally speaking, call options are used for bullish strategies, whereas put options are for bearish ones.

A 0.70 put-to-call ratio indicates that put options open interest lags the more bullish calls and is therefore positive. In contrast, a 1.40 indicator favors put options, which can be deemed bearish.

Related: ‘Liquidity’ has most affected Bitcoin’s price in the last year, according to trader Brian Krogsgard

BTC options volume put-to-call ratio. Source: laevitas.ch

BTC options volume put-to-call ratio. Source: laevitas.ch

Apart from a brief moment on Feb. 25 when Bitcoin’s price traded down to $22,750, the demand for bullish call options has exceeded the neutral-to-bearish puts since Feb. 14.

The current 0.65 put-to-call volume ratio shows the Bitcoin options market is more strongly populated by neutral-to-bullish strategies, favoring call (buy) options by 58%.

From a derivatives market perspective, bulls are less likely to fear the recent 5.5% decline in total market capitalization. There is little that federal judges or the IMF can do to severely impair investors’ belief that they can benefit from decentralized protocols and cryptocurrencies’ censorship resistance abilities. Ultimately, derivatives markets have shown resilience, paving the way for further upside.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.