The crypto market turmoil entered the third week of September as most of the cryptocurrencies started the week on a bearish note. The total crypto market cap dipped below $1 trillion again, with several cryptocurrencies recording a double-digit downfall over the past 24 hours.

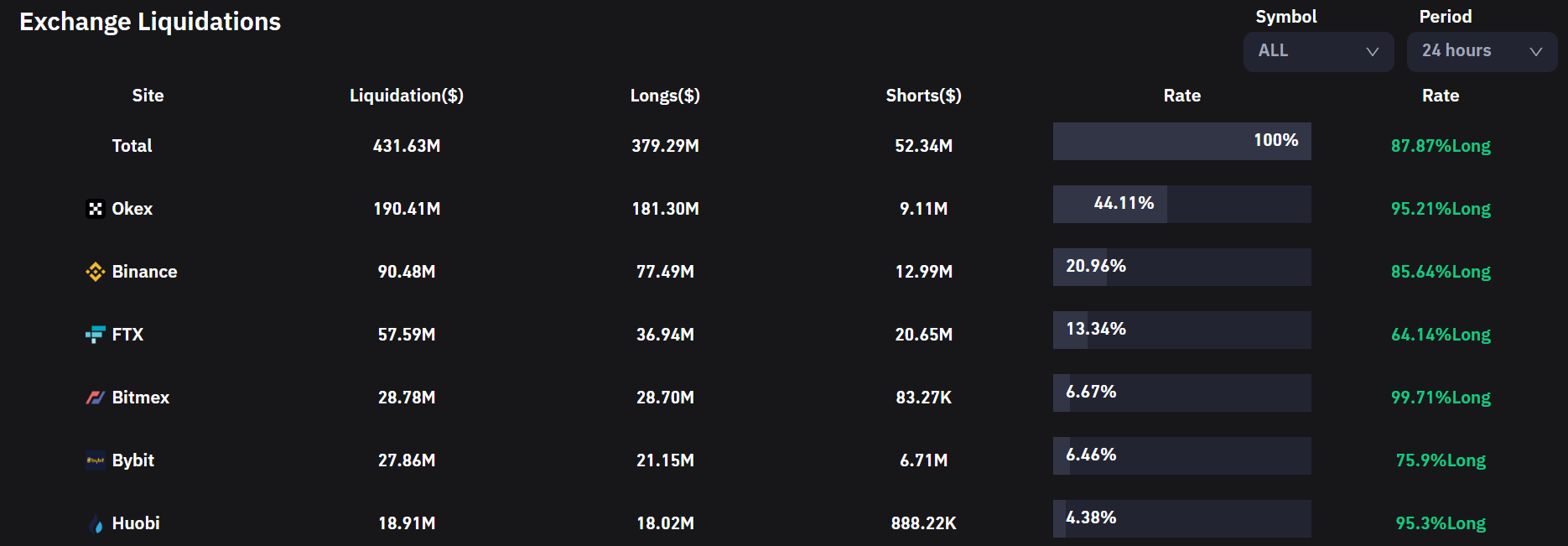

The ongoing bearish turmoil has led to nearly half a billion in liquidations for the leverage crypto traders over the past 24 hours. Data from Coinglass highlight that 130,087 traders were liquidated with a total liquidations value of $431.51 million. Bitcoin (BTC) leverage traders lost $44.5 million, followed by Ether (ETH) traders with a total liquidation of $8.39 million.

Long traders made a significant chunk of losses on majority of the exchanges with the average difference between the amount of long and short liquidations being 10X.

Liquidations on Different Exchanges Source: Coinglass

Liquidations on Different Exchanges Source: Coinglass

The current market turmoil is being attributed to several macroeconomic factors, including the recently released consumer price index (CPI) data released on Sept. 13 that showed inflation is yet to cool off. BTC’s price fell nearly $1,000 within minutes of the CPI data release. Since then, the market showed some will to move up over the weekend but saw another bloodbath earlier on Monday.

US inflation shows persistent US retail inflation w/acceleration at August core. Headline drops less than forecast to 8.3%, while Core CPI rose to 6.3%. pic.twitter.com/ZAhxPUlvjn

– Holger Zschaepitz (@Schuldensuehner) September 13, 2022

The higher CPI data is expected to be followed by a Fed rate hike in the upcoming meeting scheduled for Sept. 21. Market pundits have predicted that the rate hike could be the biggest in 40 years as a measure to control the soaring inflation.

According to the CME FedWatch Tool, the market has now fully priced in a minimum 75-basis-point hike for the Fed funds rate and is not discounting the chances of 100 basis points. A 100-point increase would be the Fed’s first such action since the early 1980s.

Related: Here is why a 0.75% Fed rate hike could be bullish for Bitcoin and altcoins

The recently concluded Ethereum Merge was also blamed by many as a buy the rumor, sell the news” event, where the price of Ether (ETH) rose as high as $2,000 in the run-up to the Merge, but has now declined to $1,300 post Merge.

The majority was right. The #Ethereum Merge was a sell the news event.

– MMCrypto (@MMCrypto) September 15, 2022

With the stock and crypto markets seeing a similar bearish trend, popular trader Clark was quick to point toward the similarities of current market conditions to that of the 1970s.

Also worth noting, leading into this, market behavior is on par with previous years in terms of realized vol.

Nov-December should be good months.

(Past returns not predictive of future results) pic.twitter.com/KKOKEIIvis

– Clark (@CanteringClark) September 18, 2022

In his tweet, Clark noted that the market could turn bullish again towards the end of the year in the months of November and December. Thus, the crypto market could see another bullish rally in tandem with the stock market towards the end of 2022.