Amid bullish action on cryptocurrency markets, Bitcoin (BTC) mining firm Argo Blockchain has regained stock listing compliance with Nasdaq.

Argo officially announced on Jan. 23 that the company regained compliance with Nasdaq’s minimum bid price rule amid the share price recovery.

The Nasdaq stock market listing qualifications department has informed Argo that it successfully met a requirement to maintain a minimum closing bid price of $1 for ten consecutive trading days. This requirement was met on Jan. 13, with Nasdaq confirming that it considers the matter closed.

The announcement comes about a month after Nasdaq notified Argo on Dec. 16 that the firm wasn’t compliant with Nasdaq’s minimum bid price requirement. The issue was due to Argo’s common stock failing to maintain the minimum bid price of $1 over the previous 30 consecutive business days, as required by Nasdaq’s listing rules.

Moreover, financial problems amid escalating energy costs and the falling Bitcoin (BTC) prices had forced the mining company to suspend trading on Nasdaq momentarily.

Argo’s American depositary shares (ADS) started trading on the Nasdaq Global Select Market under the ticker symbol ARBK in September 2021. Debuting at a price of $15, ARBK shares have been gradually selling off, eventually tumbling below $1 in October 2022.

Related: Argo Blockchain sells top mining facility to Galaxy Digital for $65M

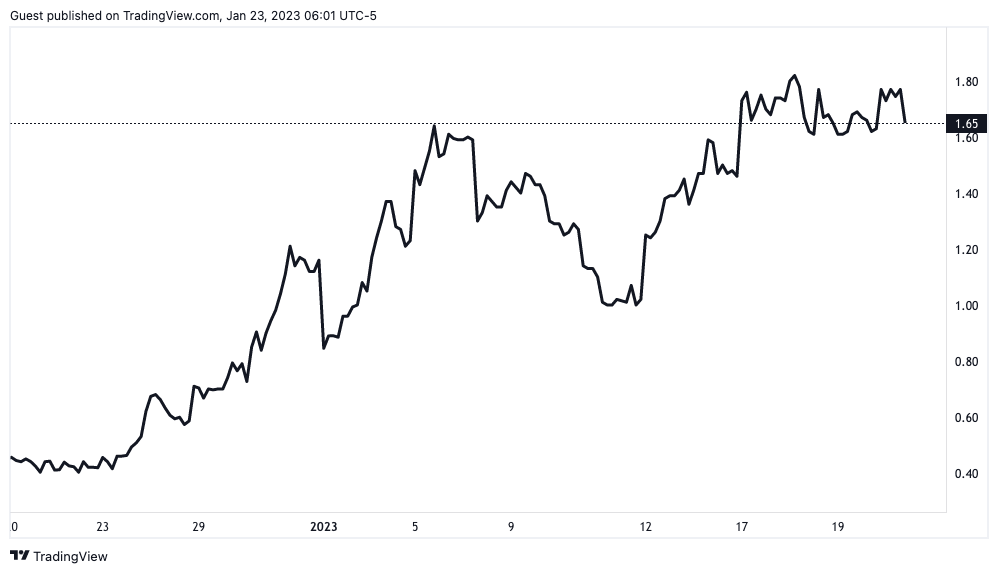

ARBK shares started recovering subsequently after Nasdaq warned the firm about becoming noncompliant in December. According to data from TradingView, Argo’s stock briefly reached $1 on Dec. 30 but failed to maintain the price. After retesting $1 on Jan. 3, ARBK stock has continued to be trading above the price level. On Jan. 20, the stock closed at $1.73.

ARBK’s 30-day price chart. Source: TradingView

ARBK’s 30-day price chart. Source: TradingView

Argo is not the only publicly-listed Bitcoin mining firm that has been struggling to maintain its share prices above $1. On Dec. 15, the Canadian Bitcoin mining company Bitfarms received a similar warning from Nasdaq over its Bitfarms shares (BITF).

Unlike ARBK, Bitfarms’ shares have not recorded enough growth to comply with Nasdaq’s listing rules yet. After breaking above $1 on Jan. 12, BITF tumbled below the threshold again on Jan. 18. According to Nasdaq’s requirements, Bitfarms has to have its shares trading above $1 for at least 10 days before June 12, 2023.