A 48% Bitcoin (BTC) price surge since the start of the year has pushed BTC’s market cap past that of payment processing giant Visa once again.

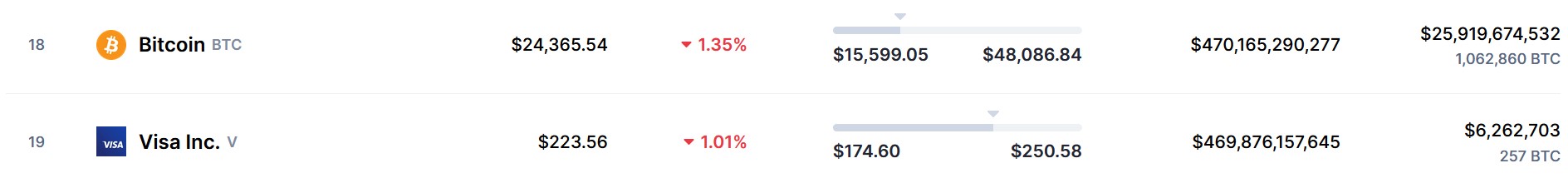

With the BTC price currently at $24,365, its market cap of $470.16 billion is now marginally above that of Visa with a market cap of $469.87 billion, according to CoinMarketCap.

BTC has “flippened” Visa again. Source: CoinMarketCap.

BTC has “flippened” Visa again. Source: CoinMarketCap.

This is the third time that BTC has “flippened” the market cap of Visa, according to Companies Market Cap.

The first time came in late December 2020 when BTC also happened to hit $25,000 for the first time. This was achieved during a price surge that saw BTC rally from $10,200 in September 2020 to $63,170 seven months later in April 2021.

Visa re-took the lead between June and October 2022, which then saw BTC surpass Visa for a very brief moment on Oct. 1 before the payments company re-captured the lead again.

This lead was widened when the collapse of cryptocurrency exchange FTX shaved off over $100 billion from the BTC in four days between Nov. 6-10, 2022.

However, since then, BTC has fully recovered and stacked an additional $65 billion on top of its Nov. 6 market cap of $408 billion to overtake the payment processing giant.

BREAKING: #Bitcoin market cap is now worth more than Visa ‼️#BTC #Crypto #CryptoNews #cryptocurrecy #cryptomarket pic.twitter.com/rZrLufkwLj

– Ajay (everything hindi) (@EverythingAjay) February 19, 2023

It should be worth noting that given the small difference in market cap between BTC and Visa, the two are currently flipping each other by the hour.

Related: What is the Lightning Network in Bitcoin, and how does it work?

As for BTC’s impressive start to 2023, its third “flippening” of Visa came on the back of 14 consecutive days of price increases between Jan. 4-17.

BTC is also well ahead of the second largest payment processing network Mastercard, which currently has a market cap of $345.24 billion, according to Google Finance.

The #Bitcoin Strategy is the Winning Strategy. pic.twitter.com/AR9R1Dxj5G

– Michael Saylor⚡️ (@saylor) February 17, 2023

BTC is still however down 63% from its all-time-high price of $69,044, which was reached on Nov. 10, 2021.