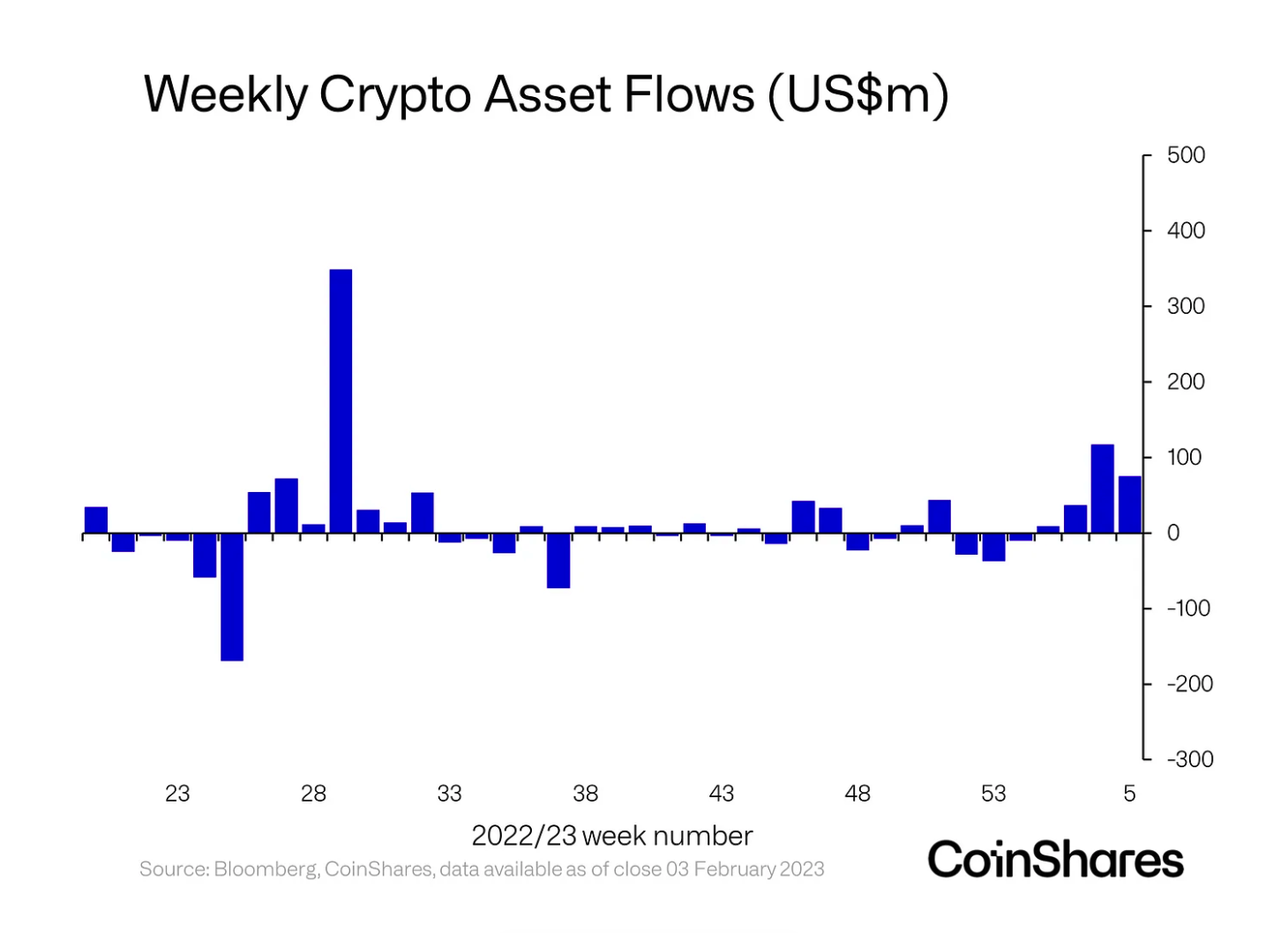

On Feb. 6, European cryptocurrency investment firm CoinShares published its “Digital Asset Fund Flows Report,” which revealed that investors are showing a strong interest in digital asset investment products, with inflows totaling $76 million last week, marking the fourth consecutive week of inflows.

The report indicates a change in investor sentiment for the start of 2023, with year-to-date inflows now at $230 million. This growth has led to an increase in total assets under management (AUM), which now stands at $30.3 billion – the highest since mid-August 2022.

Investors are primarily focusing on Bitcoin (BTC), with weekly inflows of $69 million, accounting for 90% of total flows for the week. This investment growth primarily comes from the United States, Canada and Germany, with weekly inflows of $38 million, $25 million and $24 million, respectively.

However, opinions are divided over the sustainability of this growth, with short-Bitcoin inflows totaling $8.2 million over the same period. Although these inflows are relatively small compared to long-Bitcoin inflows, they have increased by 26% of total AUM over the last three weeks. Despite this, the short-Bitcoin trade has not attracted sizable interest year-to-date, with total short-Bitcoin AUM falling by 9.2%.

Altcoins also saw some minor inflows, with Solana (SOL), Cardano (ADA) and Polygoin (MATIC) investment products all posting modest declines. Despite the growing clarity around unstaking, Ether (ETH) producers only received $700,000 in inflows.

Related: Digital asset investment products see highest inflows since July 2022: Report

Overall, positive inflows into digital asset investment products highlight investors’ growing confidence in the market. Altcoin activity also suggests that the digital asset market remains diverse and constantly evolving.