The Financial Stability Board (FSB), the financial regulator funded by the Bank for International Settlements (BIS), is pushing international regulations for decentralized finance (DeFi).

The FSB on Feb. 16 issued a report on the financial stability risks of DeFi, highlighting major vulnerabilities, transmission channels and the evolution of DeFi.

Despite providing many “novel” services, DeFi “does not differ substantially” from traditional finance (TradFi) in its functions, the authority said in the report. By trying to replicate some functions of TradFi, DeFi increases potential vulnerabilities due to the use of novel technologies, the high degree of ecosystem interlinkages and the lack of regulation or compliance, the FSB argued.

Moreover, the actual degree of decentralization in DeFi systems “often deviates substantially” from the stated claims of the founding originators, the authority claimed.

In order to prevent the development of DeFi-associated financial stability risks, the FSB is cooperating with global standard-setting bodies (SSB) to assess DeFi regulations across multiple jurisdictions.

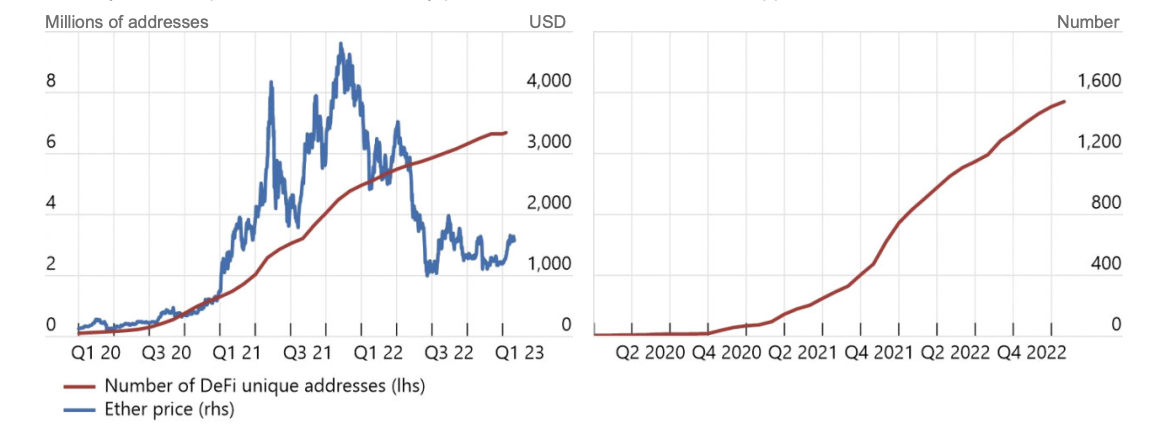

Monthly DeFi unique addresses and number of DeFi apps. Source: FSB

Monthly DeFi unique addresses and number of DeFi apps. Source: FSB

In this regard, a key element to consider would be the entry points of DeFi users, including stablecoins and centralized crypto asset platforms, the FSB said, adding:

“The FSB may consider whether subjecting these crypto-asset types and entities to additional prudential and investor protection requirements, or stepping up the enforcement of existing requirements, could reduce the risks inherent in closer interconnections.”

The FSB emphasized that both asset-backed stablecoins like Tether (USDT) and algorithmic stablecoins like Dai (DAI) play an important role within the DeFi ecosystem through their use in purchasing, settling, trading, lending and borrowing other crypto-assets. The rise of stablecoins would also likely increase the adoption of DeFi solutions by retail and corporate users as well as facilitate the adoption of crypto assets as a means of payment, the regulator suggested.

“With respect to liquidity and maturity mismatch issues, stablecoins are a crucial area of focus,” the FSB wrote, stressing the need to understand the peculiarities of different stablecoins in order to monitor the risk they pose to the crypto industry, including DeFi ecosystems.

Related: Circle squashes rumors of planned SEC enforcement action

The news comes amid the increasing scrutiny of some major stablecoins by global regulators. On Feb. 13, blockchain infrastructure platform Paxos Trust Company announced that it will stop issuing Binance USD (BUSD) stablecoins amid the ongoing probe by New York regulators. The New York Department of Financial Services ordered Paxos Trust to stop BUSD issuance, alleging that BUSD is an unregistered security.