This short-term decline in investments can be correlated to the recent market correction, which made Bitcoin (BTC) and other major cryptocurrencies lose 50% or more of their value.

According to new data released by Dove Metrics, total venture capital investment in crypto declined 38.2% over the past month, from $6.8 billion in April to $4.7 billion in May, while surging 97.8% since last year.

Data on investment distribution showed infrastructure companies received 21% of the pie, while decentralized finance (DeFi) startups accounted for 14%. Centralized finance (CeFi) and nonfungible token (NFT) projects each accounted for 13%.

This goes to show that venture capital funds might be playing safe by investing in core technologies that actually bring innovation to the crypto space, instead of riskier projects.

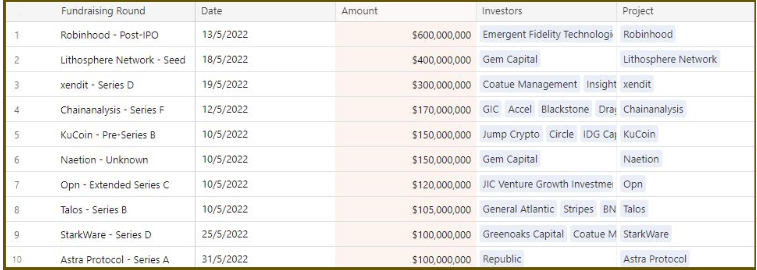

Venture funding amounts by company. Source: Dove Metrics

Venture funding amounts by company. Source: Dove Metrics

Some examples of this investment trend include Xendit, a payment gateway solution that focuses on Southeast Asia, and Lithosphere, a next-generation platform for cross-chain decentralized applications, raising $700 million combined.

The largest allocation in May was led by Sam Bankman-Fried, founder of the popular crypto exchange FTX, who invested $650 million into the popular brokerage platform Robinhood, securing 7.6% of company shares.

Other important investments include the renowned analytics company Chainalysis and KuCoin, one of the biggest crypto exchanges, raising more than $150 million each.

Largest crypto venture funds. Source: Dove Metrics

Largest crypto venture funds. Source: Dove Metrics

Data shows the United States as the largest source of venture investments, followed by Singapore and Hong Kong, a statistic that matches the global trend for VC.

Some of the biggest venture capital names include Andressen Horowitz, with $4.5 billion raised for Web3 projects, bringing its total crypto investment allocation to $7.6 Billion. The firm is known for backing several successful projects in the past, such as Coinbase or Solana (SOL).

Another big name is NGC Ventures, a Singapore-based firm that recently raised $100 million, aiming for “high-potential projects” in the Web3 space. Some of its successful previous investments include Algorand (ALGO) and Oasis (ROSE).

Related: Cointelegraph Research launches venture capital database

Despite the current crypto recession, venture capital seems to be more active than ever, with JPMorgan stating that the recent Terra ecosystem collapse didn’t affect VC. This showcases an underlying trust in crypto and blockchain technology evolution in the long term, with innovative technologies like Web3 and DeFi taking the lead.